WFA Musings - Winter 2023/24

I have traditionally sent out my Musings on a current topic of note like AI, the economy, CEO “hot buttons,” etc.… This Musings is different. It announces a breakthrough capability that we have developed at Acropolis that will shake up the strategy consulting industry and provide greater value to clients.

I have been blessed to partner with the greatest strategy minds of our lifetime. For example, renowned Harvard Business School University Professor, Michael Porter, and Bill Bain, who was undoubtedly the world’s best strategy practitioner. They held dear the notion that to be a great company, leadership in your properly defined market is imperative. Porter’s Five Forces, Value Chain, and Shared Value concepts are etched in the minds of millions of business folks around the globe. Bain’s insistence that strategy is only as good as the ability to implement it effectively remains sacrosanct.

These are immutable precepts that govern the success or failure of companies. Michael Porter’s seminal work on competitiveness is timeless. In the late 90’s and early 2000’s I quantified his thinking in a construct I called the Full Potential Paradigm™. Together we came up with a new and breakthrough framework which we call Competitive Strategy 2.0. While Mike has now fully retired from all of his teaching and business activities and is enjoying his well-deserved time with his family, I humbly submit that this new strategic construct is a fitting capstone to his illustrious career.

Before I discuss this breakthrough further, some context is necessary. Over the past few months, I have read a number of 2024 prognostications by authors at esteemed publications about pretty much anything they thought their readership would enjoy. The predictions covered a wide range, from what Margot Robbie would wear to the Oscars (my money is on pink), to the rate of melting on Greenland’s Jakobshavn iceberg, to estimates on all things in economics around the world from GDP to interest rates and inflation to geopolitical predictions. Did you know that the Economist picked Greece as their country of the year given its dramatic turnaround? These prognosticators covered the gamut and while some will be prescient and remembered, many will go down as entertaining and forgotten by Summer.

In my view, there are a few items that I believe are here to stay:

The CEO job is going to get more tricky, demanding, and lonely.

GROWTH and TALENT will be on the CEO agenda ad infinitum.

The Fed holds the Big Stick when it comes to the state of the world economy and those that believe they will soften their stance on achieving 2% inflation will be disappointed.

While the US Presidential election will have plenty of fireworks and garner much attention, the American experiment will continue to survive and thrive.

The technological revolution that has brought us generative AI is not only a new and permanent fixture, but one which will accelerate over time and change everything it touches.

While ESG appears to be verboten in business circles, companies that treat the stakeholder capitalism and sustainability movements as a compliance exercise rather than a strategic exercise will atrophy and fail.

Let’s dive in further into the last point. When Porter convinced me to start Acropolis Advisors with him in 2020, we began our journey by tackling the various challenges created by the stakeholder capitalism sustainability movements.

These overlapping movements are met with understandably high levels of criticism and cynicism.

The ESG rating systems are numerous, opaque, and often in conflict with one another.

A large number of ESG-designated investment funds are dubious.

Suggesting that shareholders are on equal footing with employees, suppliers, customers, and communities is as glib as suggesting that modern corporations don’t already focus on customers, employees, suppliers, and communities, as well as shareholders.

At the end of the day, shareholders need to receive attractive levels of return on their investment in a company or they will take their money elsewhere. Our research has shown that for Fortune’s “World’s Most Admired Companies,” the only correlating factor to being the industry leader is sustainable increases in market value. Companies that don’t deliver those results not only leave the most admired list but are unlikely to survive as independent entities. The bottom line is: if you don’t satisfy investors, you don’t survive. It is up to the CEO and management team to balance the needs of the non-shareholder stakeholders within the context of first satisfying shareholders.

Contrary to popular opinion, we believe the vast majority of CEOs are doing just that already and have been for quite some time. The business world is not run by the likes of Madoff, the former Enron CEO Jeffrey Skilling, the Purdue Pharma owned Sackler family, or a handful of other ne’er-do-wells. The vast majority of CEOs are way ahead of the “ESG police” and take pride in delighting their customers, motivating their employees, respectfully working with their suppliers, and giving back to the communities that they inhabit. But they do so by delivering attractive shareholder rates of return as defined by Total Shareholder Return, which captures both stock price appreciation and dividends. For all of the fear mongering about veering towards democratic socialism, successful CEOs continue to be adept at balancing the needs of their stakeholders while producing peer-beating returns over a three plus year timeframe.

What we’ve found from our vast network of CEO and board contacts is that while CEOs and Boards have been gung-ho to establish a sustainability group headed by a Chief Sustainability Officer responsible for producing a very glossy sustainability report filled with reams of data, they’ve generally viewed this exercise as a compliance drill and not a strategic imperative. And why should they think any differently? The various ESG measuring systems are laundry lists of aspirational items that have scant relevance to the strategy and modus operandi of any one company.

With the European regulators far ahead of the American regulators in demanding certain levels of compliance in the realm of environmental and consumer protection, our position is that it is only a matter of time before the American regulators follow suit, as the SEC is currently doing.

As staunch capitalists, we feel strongly that it is time for public multinationals to take the lead in establishing a framework that pivots off the mission and strategy of the company and integrates the strategic highlights and the economic and social benefits that the company produces. Instead of providing two silos of information, the company should make it clear what it is they value and measure on the economic and social fronts for each stakeholder.

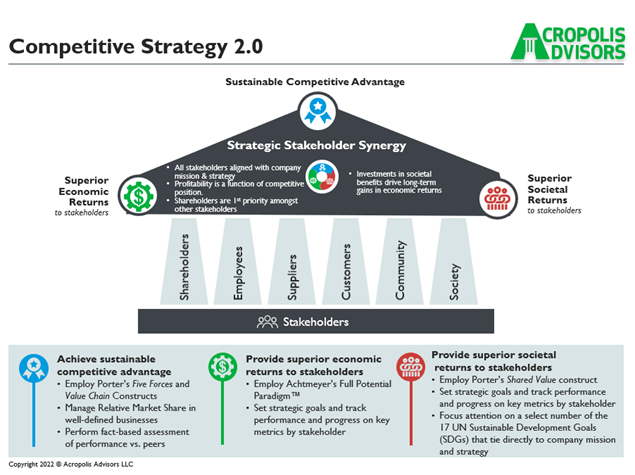

This is where Competitive Strategy 2.0 comes into play. We have developed a strategic framework that integrates traditional economic and business metrics with relevant “social” metrics to form a holistic picture of a company’s stakeholder performance both absolutely and relatively to the industry in which the company competes.

What makes Competitive Strategy 2.0 unique is that it provides a holistic picture of the company’s performance across the spectrum of competitive, economic, and social performance metrics for the most critical drivers for each stakeholder. Former Vanguard chief, Jack Brennan, said “this is revolutionary and should be embraced by all publicly traded companies.”

We are data-driven and analytic by nature. We can assure you that this is the most advanced and sophisticated strategy construct in the world and encourage you to read more about the construct through the links provided. In particular, I would direct you to the Competitive Strategy 2.0 Dashboard on page six of the Competitive Strategy 2.0 whitepaper. With the public and private information resources today along with the advances in artificial intelligence, we are convinced that CEOs can make better decisions in propelling their companies forward and stakeholders can be more informed on the realities of the possible, much less the full potential of their company.

We strongly advocate for companies to “take the bull by the horns.” Passive resistance is illusionary. The Millennials and Z generations will demand it.